We’ve all seen the trend of advertising gravitating away from traditional print, to tv, to digital with digital advertising now being the largest portion of total advertising. It’s also growing the fastest to boot, with programmatic ads leading the charge because of their ability to optimize the advertisements shown to end consumers. The future looks very bright indeed for programmatic advertisers as well as publishers, but this success brings it’s own set of new problems.

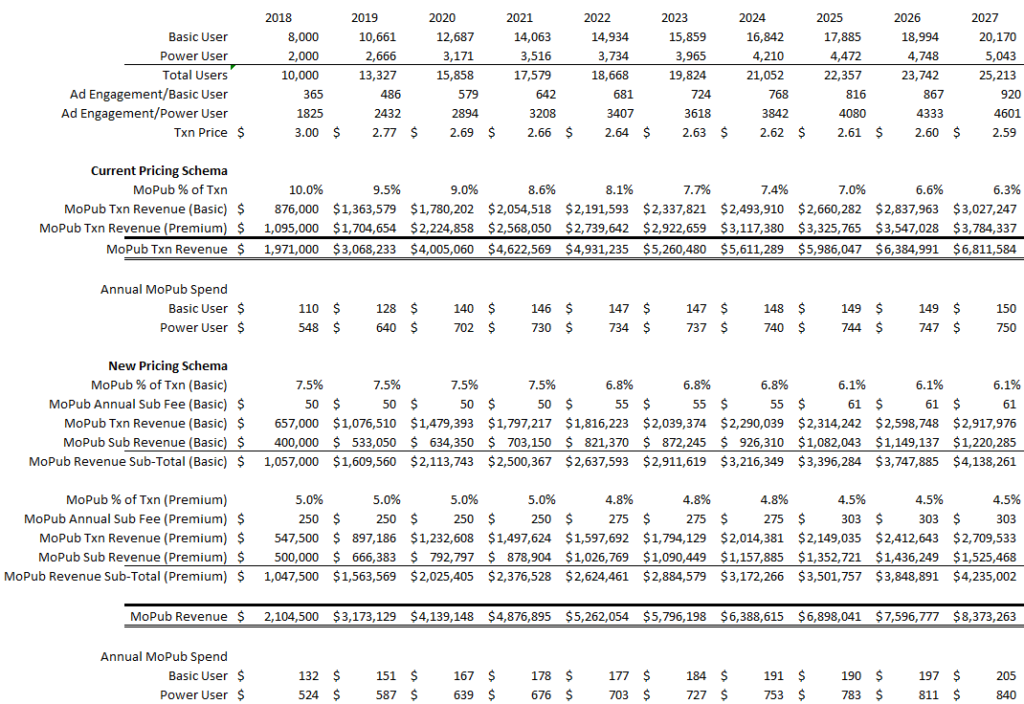

With ad exchanges becoming more and more transparent, pricing has become ever more competitive, but the trend has been firmly downward for the past several years and not by small margins either. Twitter, for example, saw cost/ad engagement decline by more than 50% in 2017, by just over 20% in 2018 and we can expect the prices to continue to decline as the industry struggles to find a more stable price range. On the flip side, ad engagement is soaring, with Twitter experiencing more than 100% growth in 2017 and slightly less than 60% in 2018. This is good news for ad-exchanges, which derive their revenue from a portion of the total sale of ad space by publishers to advertisers, because the growing engagement helps offset the decline in prices; however, there is clearly a trend happening that will threaten their continued growth potential.

Ad engagement will reach a peak saturation point eventually, so we can’t expect it to offset the falling prices in cost/ad in perpetuity, cost/ad will continue to be subject to downward pressure from more publishers than ever chasing fewer advertisers, and the transaction fee that ad exchanges charge will continue to face downward pressure as the landscape gets more and more competitive since it’s hard for them to effectively differentiate themselves. Generally speaking, the broader population of publishers and advertisers don’t make extensive use of the return-on-investment (ROI) tools that ad-exchanges provide. In fact, many consider such tools to be too complicated for them and gravitate towards simpler options.

So, what to do if you’re an ad exchange seeing this looming threat to your revenue stream?

Switch to a two-tiered subscription + transaction model. Charge a subscription fee to use the ad-exchange today that equates to a portion of what the average user would spend in a year and lower the transaction fee associated with the ad exchange so that you end up where you are today in terms of total revenue derived from that user. Come up with two combinations, one for basic users and one for power users where the ROI tools are locked behind a higher paywall. What’s the point?

The lower transaction cost will be attractive to power users since they’re likely to see higher ad engagement anyway, the sub fee buffers against revenue loss caused by falling cost/ad prices, and a basic package appeals to users looking for a “simple” experience on their chosen ad-exchange platform. All else being equal, this simple change in pricing structure could boost your profits by a substantial amount, not even taking into account it may prove more attractive than the traditional pricing method and thus lead to higher growth rate in number of ad-exchanges.

Below are some numbers I threw together, taking growth numbers from Twitter’s MD&A in their 2018 annual report and using their MoPub business unit to illustrate my point:

As always, if you have questions, comments or critiques feel free to reach out to me and don’t forget to sign up to receives updates every time we publish new posts!