In my past life as a wealth advisor for ultra high networth clients, it was amazing to me the simple steps these people would take to accumulate vast amounts of wealth that most people ignore. It was also alarming how often even wealthy people ran afoul of their own spending habits and lost their hard earned savings. Whether you’re in wealth accumulation or preservation, the following tips will help you build and maintain your savings:

1. Build and Maintain a Budget

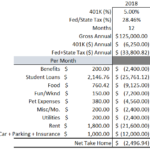

This one is obvious, but few people make one and fewer still are diligent about reviewing and maintaining it. In creating a budget, excel is your friend, but don’t worry if you’re not comfortable with it as I’ll walk you through the setup. Saver beware, the budget you made while you were in your first apartment out of college will be vastly different than the one you have later in life, even one year can make a pronounced difference, so it’s important to revisit your budget every now and then to make sure you’re not in the red and saving appropriately. The most often overlooked categories in expenses are the infrequent occurrences like medical issues, vacations and weddings but I’ve found it’s best practice to make an estimate based on prior years and spread it out over all 12 months. If nothing else, it gives you a buffer against the unexpected. Below is a very simple sample budget I helped draft for a friend who we’ll call Jason. Jason is just a couple years out of grad school, living in Chicago:

Apologies for the low resolution, but you can see that Jason is net negative for his annual budget (-$2,496.94) and that is not including any money set aside for vacation, weddings or any other large unexpected expense. While it was alarming for Jason to discover this, we were able to discuss his options and get him back in black by reducing his expenses, reducing his 401K contribution and restructuring his debt. If you need help calculating your estimated tax expense, you can use this link.

2. Consolidate & Restructure Debt

There’s a saying that goes, “the only two things guaranteed in life are death and taxes.” I’d respectfully amend that to read “death, taxes and interest.” Many people focus on savings and investing while ignoring their accumulated credit card debt and student loans. Interest rates on credit cards can range from 14% to as high as 27%, while student/mortgage loans can range from 3% to over 10% depending on the repayment structure. These are guaranteed rates of loss to your wealth. Every dollar you set aside in savings can earn as much as 1 – 2% sitting in “cash” (those rates are only achievable by putting said cash in fixed instruments called certificates of deposit which I’ll discuss in another article.). Let’s say you invest it into US stocks, the S&P 500 has earned an annualized rate of ~9% return over the past 30 years. In both cases you’re earning less than your credit card interest rate (-5% to -18% vs equity investment) and potentially less than your student or mortgage interest rate.

It is advisable to have a set amount of savings in cash for emergencies, I personally keep 6 months worth of living expenses set aside but if you can’t afford that 2 – 3 months is good as well. All cash above that benchmark should be applied against your outstanding high interest debt, which is a guaranteed rate of loss that is most likely higher than what you could earn by investing it. It is possible and advisable to consolidate your credit card debt onto the one with the lowest interest rate available to you as a way of saving money. Many credit card providers offer limited term 0% apr introductory rates for switching over to them which could save you a lot of money if you’re diligent about paying it down within the term.

3. Invest!

Once you’ve managed to set aside a slush fund and reduce your debt burden, you should definitely invest your cash. As I mentioned above, savings accounts or cash based investments yield a very small return compared to equity or longer duration and riskier fixed income instruments. You may or may not have heard of compound interest or compound returns, but it is the key to wealth creation. Here is an example:

$100 cash earning 1.5% annual interest

End of Year 1: $101.50 | End of Year 2: $103.02|…|End of Year 10: $116.05

Annual Earning Year 1: $1.50 | Year 2: $1.52|…| Year 10: $1.72

Now let’s see what the effect of compounded returns is when you’ve invested your money…

$100 invested in stocks and bonds earning 7% annual return

End of Year 1: $107.00 | End of Year 2: $114.49|…|End of Year 10: $196.72

Annual Earning Year 1: $7.00 | Year 2: $7.49|…| Year 10: $12.87

The first thing you’ll likely notice is that your money grows much larger when invested, the second thing you should notice is that the annual earnings go up despite the rate of interest/return remaining constant. That is compound interest/return. It’s important to note that equity and fixed income returns due experience volatility and I can guarantee you that no one will experience a steady annual rate of return over the course or 10 years unless they’re invested in a single fixed income instrument or invested in a fund run by a Bernie Madoff portfolio manager. I’ll also mention many other things impact the money you’ll have made, such as the timing of withdrawals. I’ll go into calculating different rates of return in another article.

If you’re not investment savvy, consider investing in a simple mutual fund combination of global equities and bonds. There are many retirement date focused mutual funds that not only assist you with achieving a proportionally weighted geographically diverse portfolio of equity and tax-status appropriate fixed income (municipal bonds vs corporate bonds), but they also adjust the weighting of equities versus bonds the close you get to retirement. They’re a good option if you’re the set it and forget it type or find periodically reviewing and adjusting your investment portfolio allocation tedious. Another good option is to hire a financial advisor; however, they can be expensive and finding a good financial advisor can be challenging. It’s important to make sure you understand their compensation structure and performance history as both can be misleading to the average person.

With these three steps you’re well on your way to attaining mastery of your finances. There’s much more you can do, but these will give you a solid foundation to work from. If you’d like a recommendation for a financial advisor, have questions specific to your situation or feedback on some of the advice I’ve given please feel free to leave a comment below or send me an e-mail. I respond to all e-mails as soon as I’m able.

Don’t forget to sign up to be notified when new articles are published.